Finley closes $17M to turn 100-page debt capital agreements into software-managed code

Christine Hall / 3:01 am PST • January 31, 2023

As venture capital investments slowed down in 2022, some startups turned to private credit, including debt capital, as a way to supplement their operations in the meantime. However, the policies and procedures paperwork that goes with these deals aren’t always easy to understand.

Finley CEO Jeremy Tsui told TechCrunch that private credit is a $1.2 trillion industry and accounts for 90% of all corporate debt in the middle-market. However, while working in debt capital at Goldman Sachs, he witnessed two things: private credit, or lending by non-bank parties, filling the gap for banks making fewer corporate loans, and then companies finding it challenging to understand the hundreds of pages in their agreements.

“With consumer credit, we’ve seen a lot of innovation, but business credit or business lending has really been stuck in the past,” he said.

That’s when he came together with his brother, Josiah Tsui, and friend Kevin Suh in 2020 to create Finley, a software company that helps clients manage their private credit loans, turning hundreds of pages of documents into digestible bites, including storing key dates, so that companies taking these kinds of loans can more easily comply with the loan terms and reporting requirements.

Finley raised $3 million back in 2021 and has now closed on $17 million in Series A capital after spending the past two years focused on…

Entocycle grabs $5 million for its insect breeding technology

Romain Dillet / 12:00 am PST • January 31, 2023

Even if insects don’t sound appealing to you, black soldier flies could play an essential role in the food chain in the coming years. In particular, these flies’ larvae can become an important source of proteins for livestock and fish.

That’s why Entocycle is raising another $5 million in a Series A funding round led by Climentum Capital, a European climate-focused VC firm. Lowercarbon Capital and ACE & Company are participating in the round as well.

Teampact Ventures is also investing in Entocycle. This new French VC firm is partnering with current and former athletes to invest in tech companies. In addition to contributing money, those sports professionals help startups with team-building advice and mentorship. In that case, Antoine Dupont, Nikola Karabatic, James Haskell and Antoine Brizard are investing in Entocycle.

While Entocycle has been around since 2016, the team of 21 people will now try and commercialize its products. In particular, with this new injection of cash, Entocycle plans to iterate on its flagship product — the Entocycle Neo.

It’s a hardware module that can be used in insect farms to monitor…

Forbes ’30 under 30′ entrepreneurs raise $3M for remote work productivity startup backed by Meta

BY NATE BEK on January 30, 2023 at 7:29 am

After more than a year of remote work, Devin Ajimine and his friends could not find a productivity tool that would help them stay focused.

So they decided to build one themselves over a weekend.

“We threw it up on TikTok, then it went viral multiple times,” said the 25-year-old Seattle entrepreneur and Hawaii native.

The tool they showcased, called LifeAt Spaces, was seen and shared millions of times on various social media platforms. Viewers were instantly drawn to the concept: Consolidating and organizing a set of productivity tools onto a single platform, letting users create their own digital office from a browser or desktop app.

Ajimine said the goal is to eliminate cluttered desktops. That thesis struck a chord: the app has been downloaded more than a million times.

LifeAt graduated from top startup accelerator Y Combinator last summer, helping convert a weekend project into a full-fledged company.

The startup has drawn attention from some notable investors, including a venture arm of Facebook parent Meta. Myspace co-founder Aber Whitcomb is also a backer, in addition to YC, Pioneer Square Labs, the venture arm of Line parent Z Holdings, Pack Ventures, Goodwater, SV Tech, and Pioneer Fund.

As an early-stage consumer startup led by young entrepreneurs, LifeAt is a…

Digital health insurance startup Angle Health closes on $58M round of funding

Digital-first health insurance startup Angle Health Inc. says it’s ready to transform the healthcare industry after closing on a $58 million early-stage round of funding.

Today’s Series A round was led by Portage, with participation from new investors PruVen Capital, Wing Venture Capital, SixThirty Ventures, Mighty Capital, Wormhole Capital, Mindset Ventures, Aloft VC and Pilot.com Inc. founder Waseem Daher. Existing backers Blumberg Capital, Correlation Ventures, TSVC and Y Combinator also joined in.

Angle Health was co-founded in 2021 by former Palantir Technologies Inc. engineers Ty Wang, its chief executive officer, and Anirban Gangopadhyay, its chief technology officer. They created the company after becoming frustrated with their experiences of the personal health insurance industry in the U.S. The startup wants to reinvent the way Americans obtain health insurance by bringing traditional healthcare providers, digital health and wellness into a single, cohesive ecosystem that promotes better health.

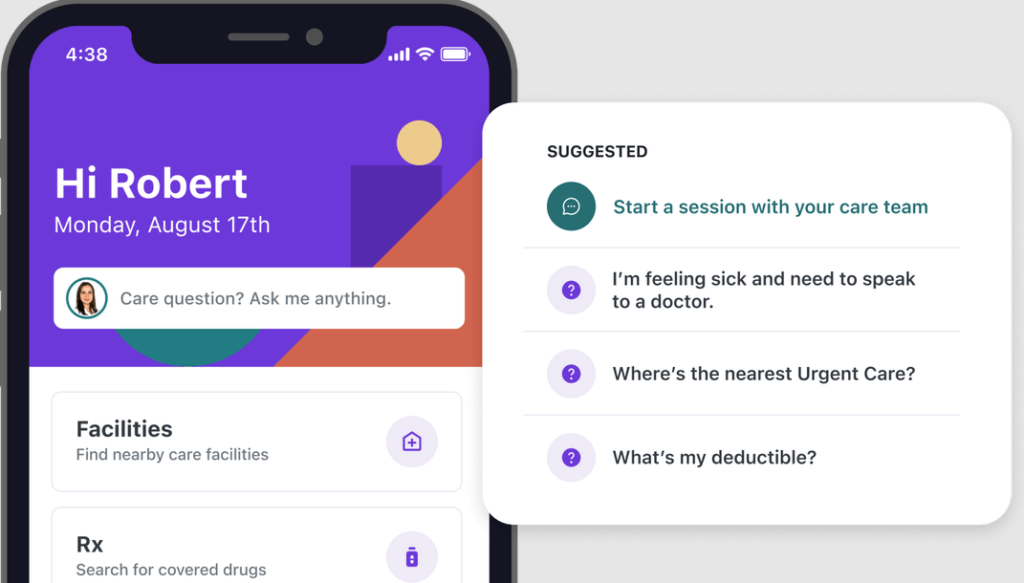

The startup participated in the accelerator Y Combinator’s Winter 2020 cohort and has been building its artificial intelligence-powered app and regulatory infrastructure since then.

Wang explained that Angle Health’s mission is to unify…

Proptech Startup Landeed Bags $8.3 Mn Funding To Reach Product-Market Fit

BY HEMANT KASHYAP – 24 Jan’23

Benglauru-based proptech startup Landeed has raised $8.3 Mn in a round of funding led by Draper Associates, Y Combinator and Bayhouse Capital.

Landeed aims to build a comprehensive property title search engine with the incoming funding, along with hiring personnel and strengthening the technological infrastructure.

The startup also plans to invest in building for the maximum number of users to reach product-market fit. Further, it plans to hire ten more software developers to help it become an IaaS (Infrastructure-as-a-Service) provider for all real estate transactions.

“As India’s real estate market is expected to reach a size of $1 Tn by 2030, this funding presents the startup with a huge opportunity in the proptech market,” the startup said in a statement.

The funding comes five months after the proptech startup raised $2.5 Mn in its Pre-Seed funding round from Y Combinator and others.

Founded in 2022 by ZJ Lin, Sanjay Mandava and Jonathan Richards, Landeed is trying to simplify property due diligence for all parties to engage, communicate and close deals. Over 100K property owners and agents have already used Landeed to buy, sell, and build real estate, claims the startup.

Landeed’s mobile app allows owners, agents, developers and legal advisors to check real estate records for building, lending and transacting properties. Landeed also plans to launch…

Amsterdam’s not8 bags undisclosed funding from Antler to help product teams save time

Amsterdam-based not8, a B2B startup that aims to standardise the product development review process, announced on Thursday that it has raised an undisclosed investment from Antler.

The Dutch startup says it intends to deploy the funds on product development and accelerate business development and growth efforts. Not8 also announced that it plans to raise pre-seed funding during the summer of 2023.

The Dutch company is addressing one of the main issues plaguing tech companies that primarily focus on PLG (Product-led growth) – Product feedback.

To achieve product-led growth, the product team needs to review a product often, and this process needs to be fixed, claims not8.

Product managers, web designers, front-end developers, and QA’s waste tens of hours per week making unnecessary calls, marking screenshots, and sending long-written explanations on needed fixes.

Here’s where not8 jumps in to …

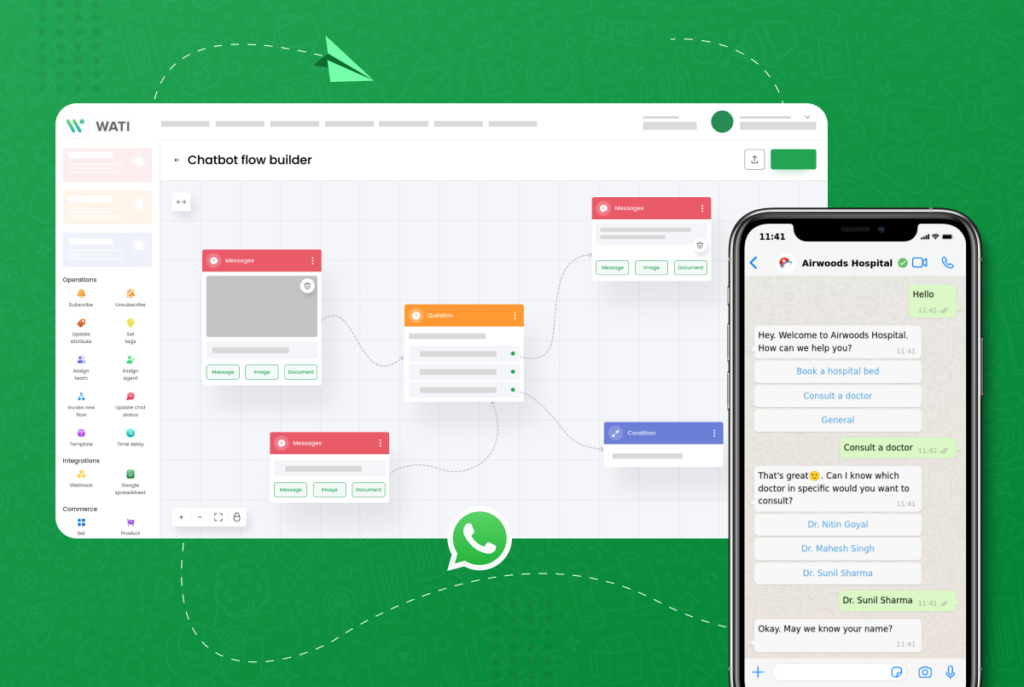

WATI, a CRM tool built for WhatsApp, raises $23M led by Tiger Global

WhatsApp is used by more than two billion around the world and is an important tool for many small businesses. But as they scale up, even WhatsApp for Business might not be able to keep up with their needs. That’s where WATI (WhatsApp Team Inbox) steps in. Built on WhatsApp for Business’ API, WATI has customer sales and engagement tools created for the messaging app. Today the Hong Kong and Malaysia-headquartered startup announced it has raised $23 million in Series B funding to scale its team and product.

The round was led by Tiger Global with participation from returning investors Sequoia Capital India & Southeast Asia and new investors DST Global Partners and Shopify (marking the e-commerce platform’s first venture investment in a startup operating in the Southeast Asia region). WATI’s last round of funding was an $8.3 million Series A announced 10 months ago and its new round brings its total raised to more than $35 million since 2020.

WATI founders Bianca Ho and Ken Yeung began working together in 2016, building Clare.AI, an omnichannel AI digital assistant for large…

Fintech Portão 3 raises BRL 19 million in seed round

Bianca Pereira and Fernando Nery are co-founders of Portão 3

Founded by Forbes Under 30 Bianca Pereira, fintech expects to triple the number of employees by the end of the year.

Fintech payment management and corporate spending control Portão 3 announced today (18) that it received a contribution of BRL 19 million in a seed investment round led by Better Tomorrow Ventures, with the participation of Fincapital, Endeavor Scale Up Ventures, Pareto , Flexport and other angel investors.

The resources will be used to hire employees, whose number is expected to triple to 100 this year, and to expand the number of products and services that the platform offers. According to Gate 3, the goal is to grow around 20% per month throughout 2023.

“Our products and services stimulate and facilitate the financial management of companies and this helps to bring technology to segments that in the last three years…

Hack The Box, a gamified cybersecurity training platform with 1.7M users, raises $55M

There’s long existed a divide in the world of computer hacking between those who are taking a malicious approach to crack a system, and those who are using the same techniques to understand the system’s vulnerabilities, help fix them and at the same time fight against the malicious actors. Today, Hack The Box, one of the startups that’s built a platform to help cultivate more of the latter group with a gamified approach, is announcing $55 million in funding to expand its business after racking up 1.7 million users.

The funding is being led by Carlyle, with Paladin Capital Group, Osage University Partners…

Gamified fintech startup Fello raises $4M led by US-based Courtside Ventures

The startup will use the funds to develop unique gamified financial products, hire talent across functions, and expand its user base in Tier I and II cities.

Bengaluru-based gamified savings platform Fello has raised $4 million in its latest round led by US-based Courtside Ventures. The round also saw participation from Entrepreneur First, Y Combinator, Kube Venture, and Upsparks, and angel investors—Kunal Shah (Founder, CRED), …

Argentinian compliance platform Celeri nabs a $2.6M seed-round

Celeri, a technology platform that automates and simplifies compliance processes in the financial industry to drive growth, received a $2.6 million investment to accelerate its expansion in Latin America. Some of the investment funds supporting Celeri include Y Combinator, Funders Club VC, Commerce VC, Pioneer Fund and 22 VC.

The platform was founded in early 2022 in Argentina by Mathias Caramutti, Lucas Ranallo and Bernardo Michell. Celeri currently has operations in Argentina, Colombia,…

Data observability startup Metaplane lands investment from YC, others

The need for data observability, or the ability to understand, diagnose and orchestrate data health across various IT tools, continues to grow as organizations adopt more apps and services. (Nearly 10% of businesses now have more than 200 apps to manage, according to a recent Okta study.) In a large-scale survey of IT decision makers published last September, 75% of the respondents said they expected to increase their observability spend in 2022 “significantly” to better plan, deploy and run software.

Observability tools to capture and analyze IT tool data aren’t new — and these days, they’re raising a respectable amount of capital. Monte Carlo, whose platform…